Belén Soriano Clavero

Assistant Director, Technical Area and Reinsurance

Consorcio de Compensación de Seguros

The Consorcio de Compensación de Seguros (CCS) was established in 1954 by merging other funds together, with the aim to take charge of insurance covers for which it retains responsibility up to the present day.

Coverage of extraordinary risks is the most important of those insurance covers from the standpoint of the quantitative surcharges collected and the types of losses handled. Initially these risks were also known as catastrophic risks.

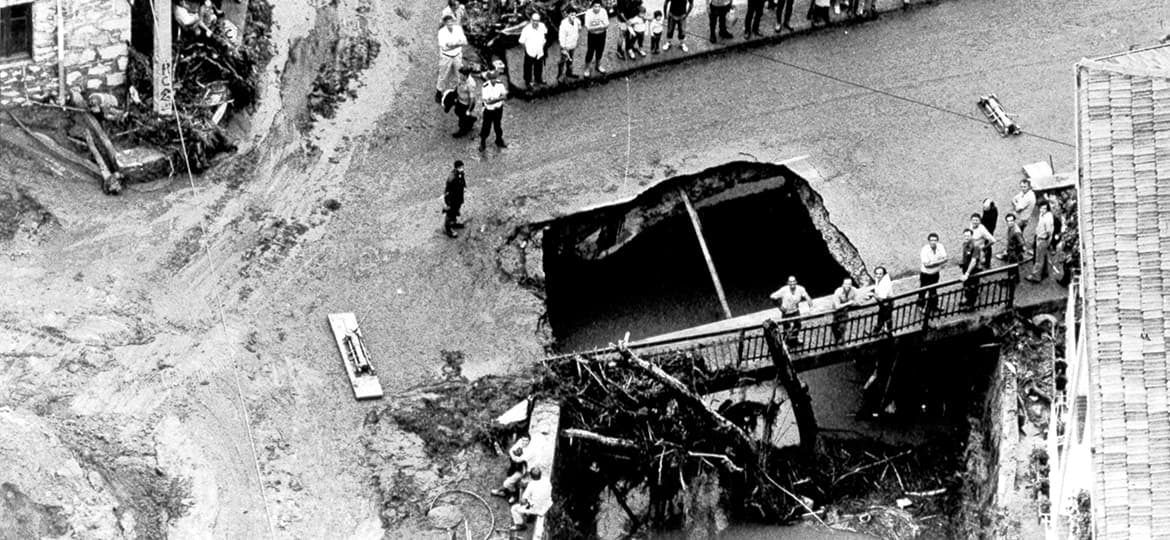

Figure 1. Busturia (Biscay), 30 August 1983. Damage caused by flooding in one of the bridges of this place.

Source: EFE.

The sections that follow single out the special legislation dealing with this extraordinary or catastrophic risk insurance scheme over the course of nearly 70 years (1954-2023). The laws specifying the covers, particularly the perils covered, are listed below together with the different surcharge rates applied over time and the deductibles discounted from coverage of these risks by the CCS.

To that end, the time elapsing between 1954 and 2023 has been split into three time intervals according to the laws specifying the covers. Each of those intervals has had different schedules of surcharge rates and deductibles, and they are also detailed in the sections that follow. The three intervals are:

The changes in the covers (specifically, the perils covered), the surcharges, and the deductibles in each of the three above-mentioned intervals are discussed below in reference to the laws in which they were prescribed.

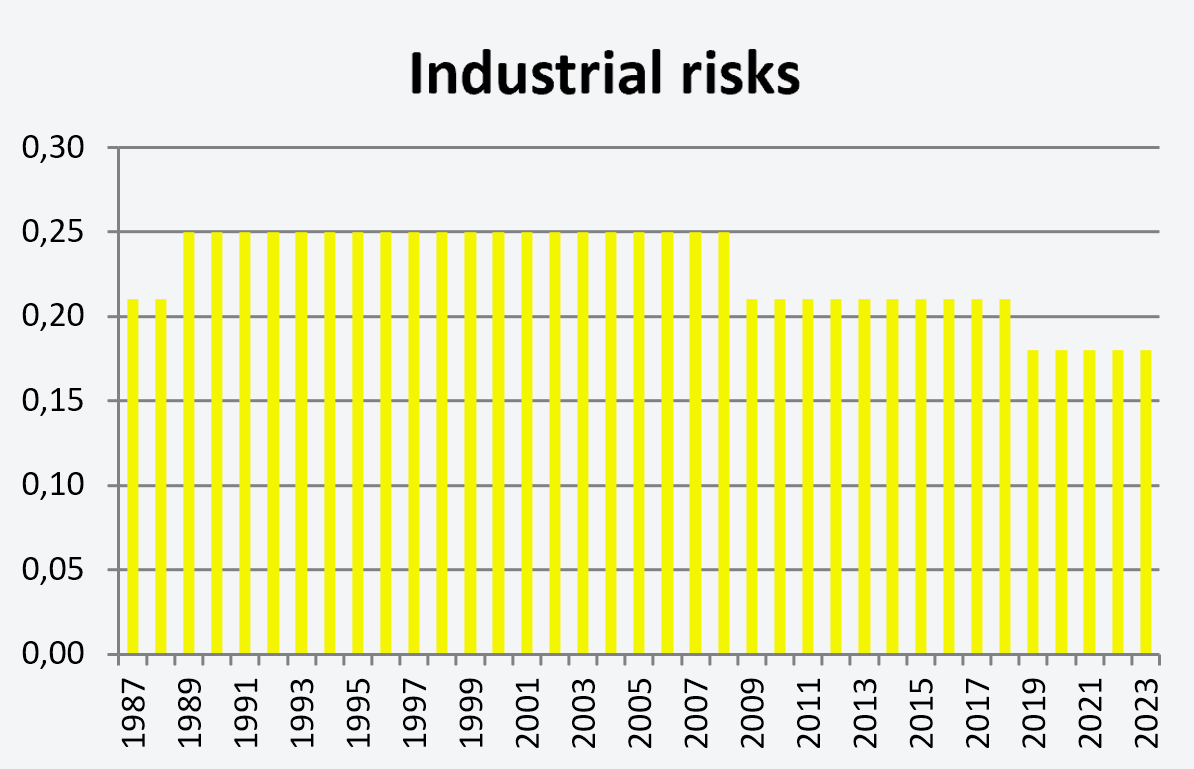

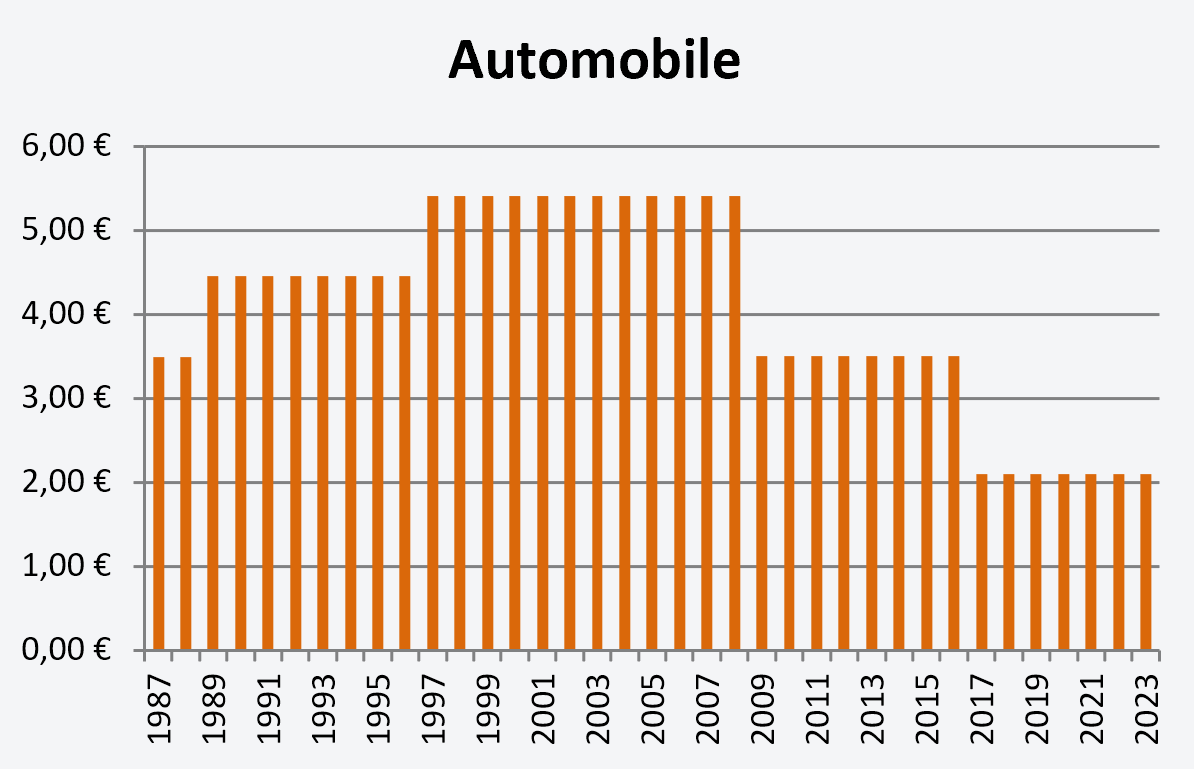

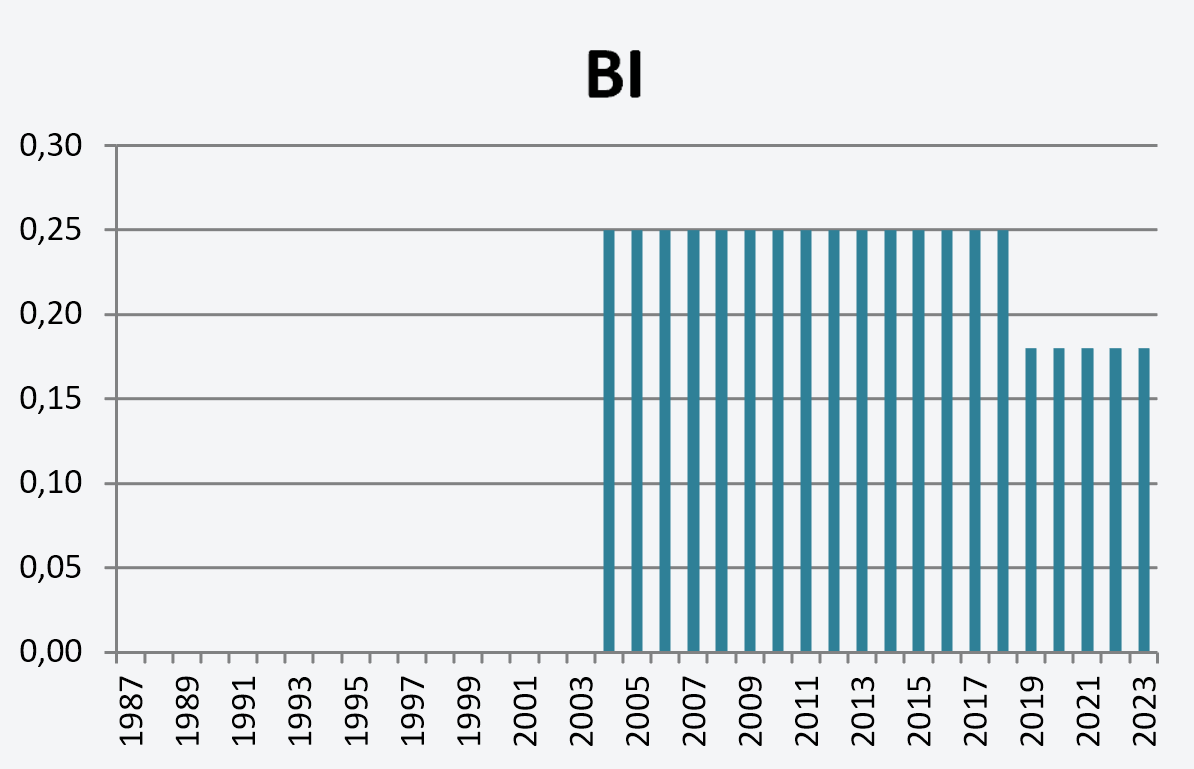

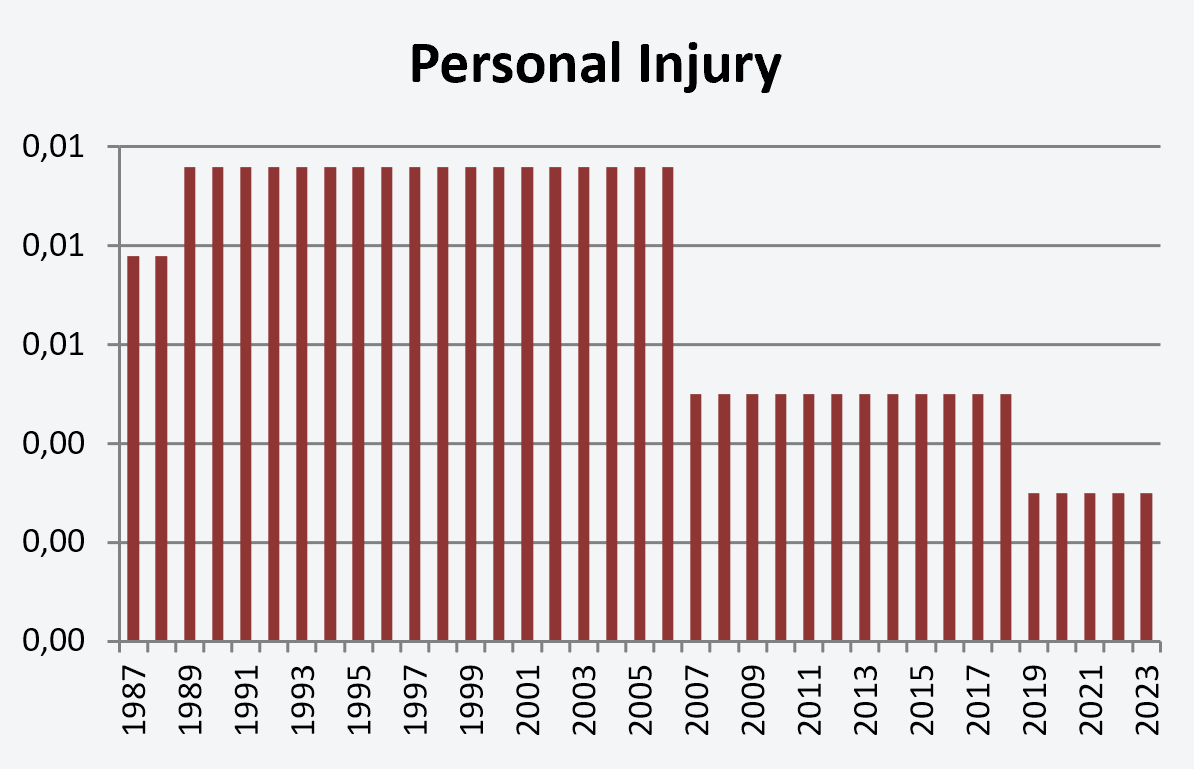

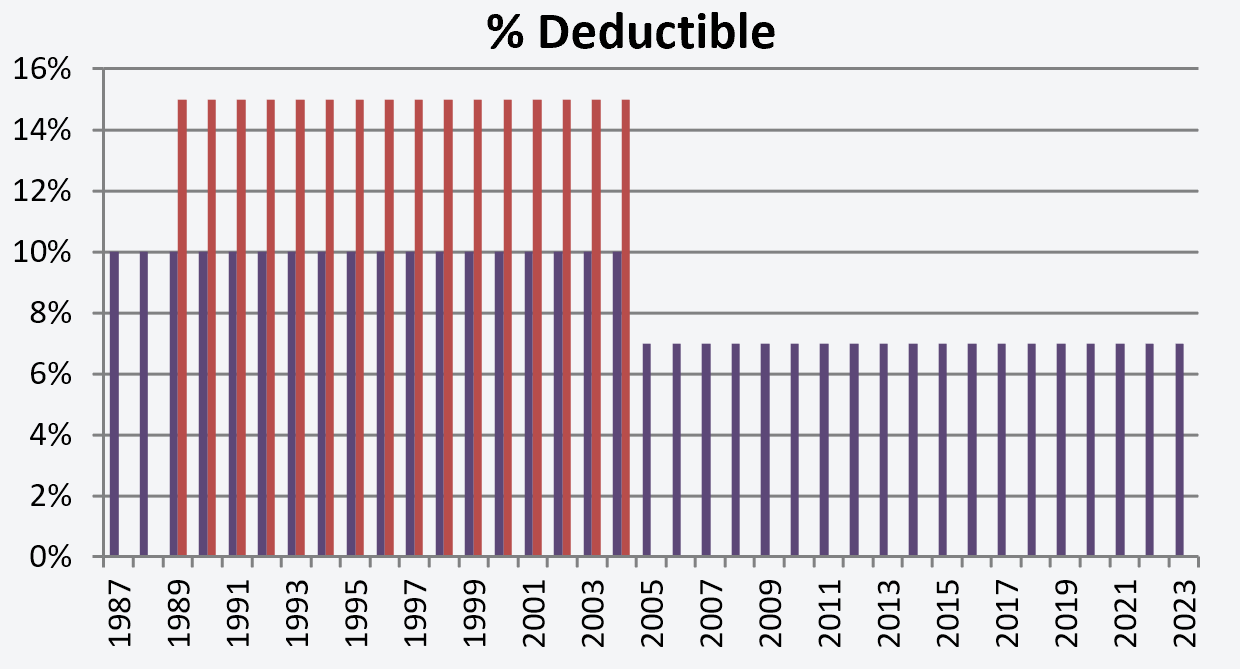

Also included are a brief conclusion together with Annexes I and II with the time series of surcharges and deductibles, respectively, during the interval spanning the CCS's current operating framework, namely, the period from 1 January 1987 to the present.

The Law of 16 December 1954 merging the Catastrophic Risk Property and Accident Insurance Compensation Funds into a single "Insurance Compensation Fund" also Covering Livestock, Forestry, and Agricultural Insurance created the CCS, though the origins of the Fund for catastrophic non-personal injury risk covers date back to 1944 and the Decreto de 5 de mayo de 1944 que crea el Consorcio de Compensación de Riesgos Catastróficos sobre las cosas [Spanish Decree of 5 May 1944 creating the Catastrophic Risk Property Insurance Compensation Fund].

The Decreto de 13 de abril de 1956 por el que se aprueba el Reglamento para la aplicación de la Ley de 16 de diciembre de 1954 [Decree of 13 April 1956 approving the Implementing Regulations to the Law of 16 December 1954] (the CCS Regulations) was published to make the above legislation maximally effective.

The basic scheme of covers, surcharge rates, and deductibles for extraordinary risks are outlined below.

By law, CCS covered unusual or extraordinary perils which were not covered under private insurance policies.

The perils covered were events of a political nature, public disorders, actions by the armed forces in peacetime, floods, volcanic eruptions, hurricanes, earthquakes, landslides, other extraordinary seismic or weather events, and more generally any extraordinary hazard not covered by regular insurance policies.

Furthermore, losses caused by hail or snow were not covered unless the events were exceptionally intense or otherwise extraordinary and had been expressly declared extraordinary by the Dirección General de Seguros y Ahorro [Bureau of Insurance and Savings Affairs] in a reasoned decision on the CCS's recommendation.

In addition to the perils expressly mentioned above, such other hazards as rainfall and hurricanes were also covered during this interval when associated with extremely adverse events.

2) The Decreto 3161/1963, de 28 de noviembre [Decree of 3161/1963 of 28 November 1963 amending the CCS Implementing Regulations] set new surcharges on premiums ranging from 1% to 15% depending on the insurance line or type of cover. It took effect on 1 January 1964.

The relevant provision was initially worded as follows:

"The share of the loss to be defrayed by the insured is as follows:

Where the sum insured under the clauses of the policy under which the claim is made is less than 50,000 pesetas, the deductible will be 1% of the sum insured.

Where the sum insured is greater than 50,000 pesetas, the deductible will be 1% of that amount plus 0.50% on the amount over 50,000 pesetas.

The minimum deductible will be 500 pesetas, and if that amount is exceeded, the maximum deductible will be 30% of the loss. Nevertheless, where called for by the circumstances, the Consorcio may decide that not to apply the above-mentioned minimum.

This deductible will not apply to losses caused by floods, inasmuch as in those cases, as provided in section 8, the indemnity paid will be only 60% or 40% of the loss assessed".

This wording was amended by Decreto 3161/1963 de 28 de noviembre amending the CCS Implementing Regulations, which took effect on 1 January 1964. The previous deductible based on the sum insured was set aside and reworded as follows:

"Deductibles and underinsurance. Losses for which the claim or damage settlement is less than one thousand pesetas will not be entitled to compensation. The amount of the deductible will be applied to indemnities greater than that sum; nevertheless, in exceptional cases, where called for by the circumstances in question, the Consorcio may decide not to apply the above-mentioned deductible.

The Finance Ministry is authorised to raise the basic amount of the deductible where called for by the circumstances on the recommendation of the Consorcio de Compensación de Seguros".

The first implementing regulations concerning extraordinary risks to people and property were enacted in 1986. These regulations contained a technical definition of the perils covered, and the CCS's insurance activities in this area were brought within the scope of the principles laid down in Ley 50/1980, de 8 de octubre, de contrato de seguro [the 1980 Spanish Insurance Contract Act].

This enumeration and definition of the perils covered supplied the requisite legal certainty for all actors involved in the extraordinary risk coverage scheme, i.e., insurers, policyholders, and the CCS itself.

The Regulations set out the overall framework for operation of the CCS in this field, and they have basically remained in effect up to the present time.

Royal Decree 2022/1986 of 29 August enacting the Implementing Regulations concerning extraordinary risks to people and property entered into force on 1 January 1987.

The scheme for setting the extraordinary risk surcharge rates was changed from a percentage of the commercial premiums charged by insurers to a per mille amount charged on the sum insured specified in the original policy. The CCS's financial resources thus no longer depended on the insurers' business policies, and revenues were linked to the actual coverage.

2) Resolución de 31/07/1987 [Decision of 31 July 1987] (amending the above decision) effective 12 August 1987.

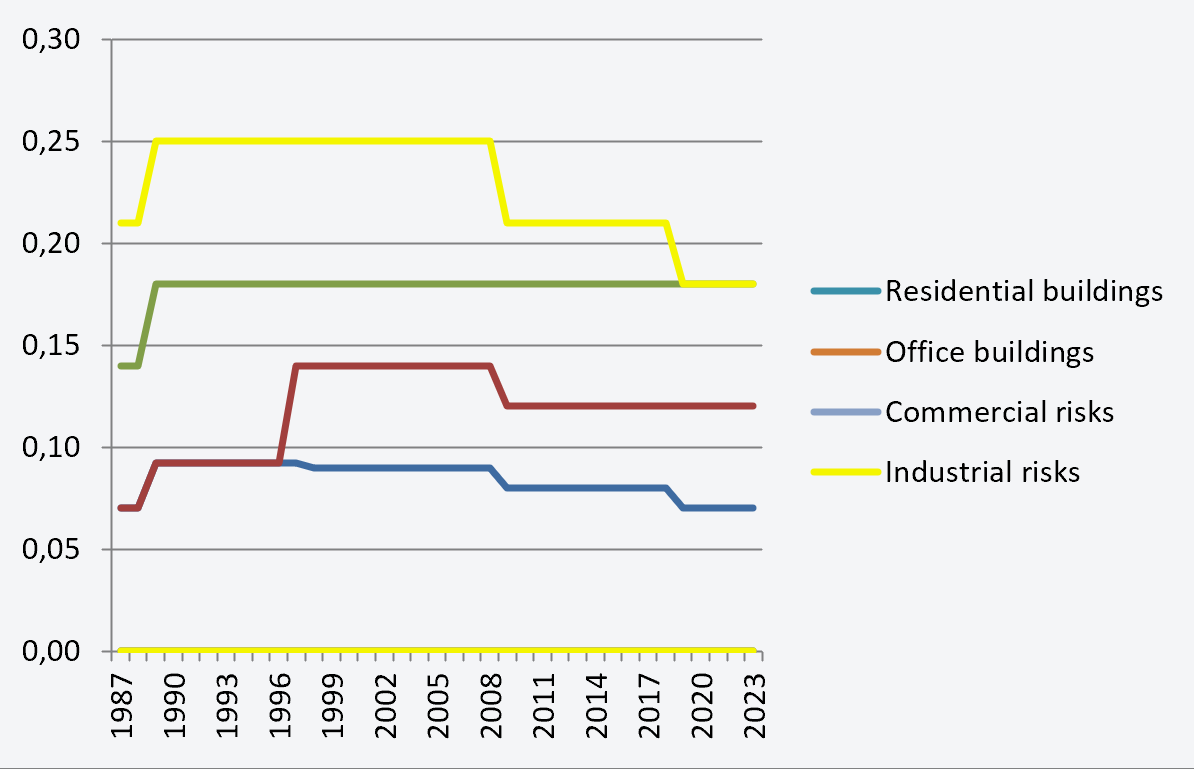

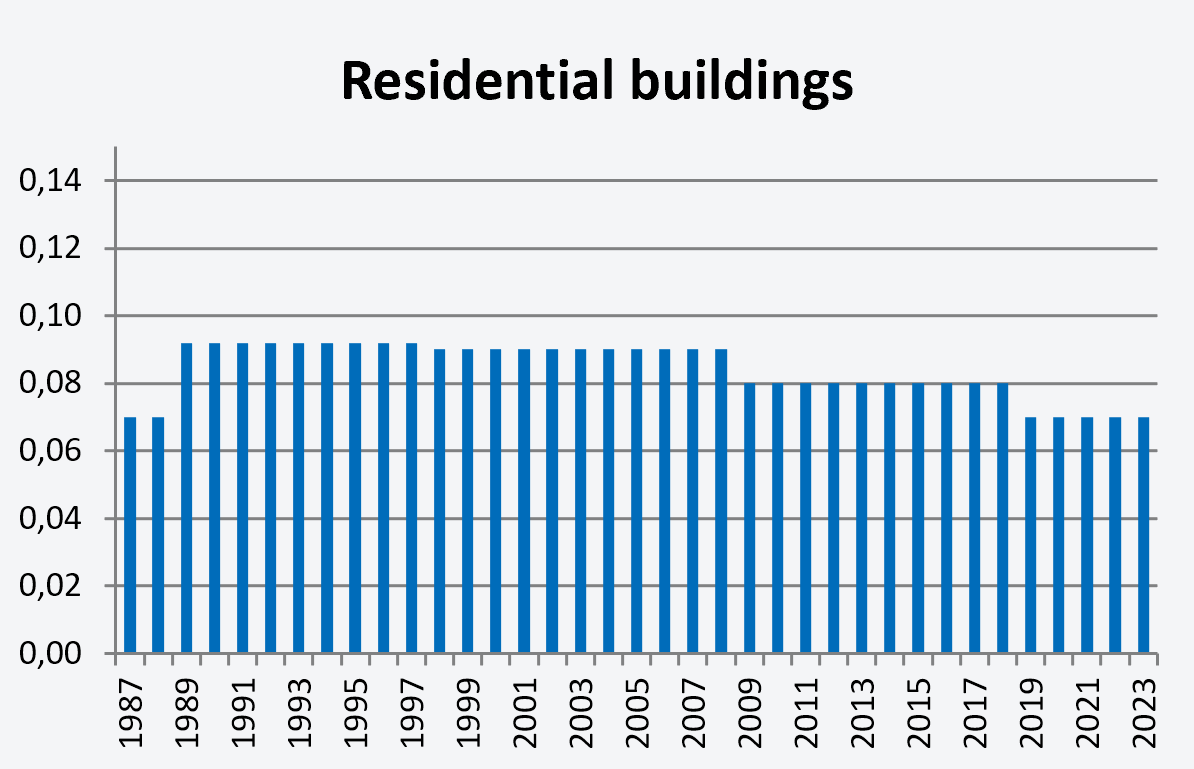

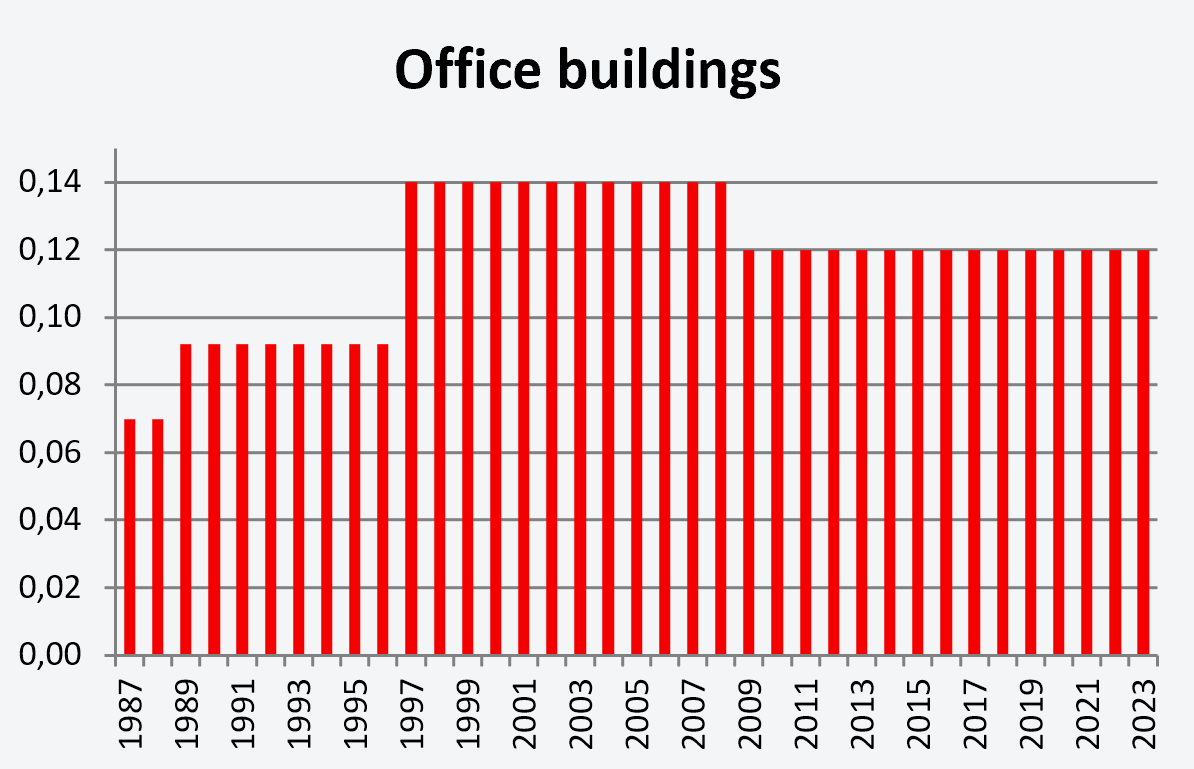

The main changes were: ending the previously extant flood surcharge for proximity to rivers, inlets, or the ocean; classifying office buildings as a separate risk category; establishing a new category of civil works, i.e., railways and pipelines; establishing a minimum surcharge for first losses; and changing the surcharge rates for certain risk categories:

Section 9 of Royal Decree 2022/1986 enacting the Implementing Regulations concerning extraordinary risks to people and property set out the deductibles to be borne by the insured, namely:

"a) For property insurance, 10% of the amount of the loss, not to exceed 1% of the sum insured and not to be less than 25,000 pesetas. The deductible will apply to each loss and to each category of risk covered for the property insured.

The Ministry of Economy and Finance is authorised to alter the minimum amount of the deductible where called for by the circumstances on the recommendation of the Consorcio de Compensación de Seguros...

b) Personal injury covers will not be subject to any deductible.”

The Orden 28 de noviembre de 1986 [Decree of 28 November 1986] altered the deductibles as follows:

"The deductible to be borne by the insured in the case of extraordinary risk covers is 10% of the net amount of the indemnity to be paid for the loss, not to be less than 25,000 pesetas and not to exceed 1% of the sum insured. The deductible will apply to each loss and to each category of risk covered for the insured property that has been damaged.

Deductibles set in the original policy do not apply for the Consorcio de Compensación de Seguros.

Personal injury covers will not be subject to any deductible.”

Real Decreto 354/1988 de 19 de abril [Spanish Royal Decree 354/1988 amending certain sections of the Implementing Regulations concerning extraordinary risks to people and property] subsequently amended the wording as follows:

The deductible to be borne by the insured will be:

"a) For property insurance, 10% of the amount of the loss, not to be less than 25,000 pesetas and not to exceed 1% of the sum insured.

However, where the sum insured is less than or equal to 2,500,000 pesetas, there will be a unitary limit, with the deductible being set at 1% of the sum insured. Where the sum insured is greater than or equal to 1,000,000,000 pesetas, the deductible will be capped according to the following scale.

| Sum Insured by tranche - In pesetas | Percentage of the loss | Absolute cap - Millions of pesetas |

|---|---|---|

| Between 1,000,000,000 and 10,000,000,000 | 11 | 12 |

| Between 10,000,000,001 and 25,000,000,000 | 12 | 15 |

| Between 25,000,000,001 and 50,000,000,000 | 13 | 20 |

| Between 50,000,000,001 and 100,000,000,000 | 14 | 25 |

| Greater than 100.000.000.000 | 15 | 30 |

The deductible will apply to each loss and to each category of risk covered for the property insured.

The Minister of Economy and Finance is authorised to alter the amount of the deductible specified in this section where called for by the circumstances on the recommendation of the

Consorcio de Compensación de Seguros.

b) Personal injury covers will not be subject to any deductible.”

The second Implementing Regulations concerning extraordinary risk covers were enacted in 2004. They kept the overall framework for operation of the CCS and introduced significant new aspects that are discussed below.

Real Decreto 300/2004 de 20 de febrero took effect on 25 February 2004.

Resolución de 27/11/2006 [Decision of 27 November 2006] effective 8 December 2006.

(i) the Resolución de 12/11/2008 [Decision of 12 November 2008] appreciably reduced rates for property damage covers. It took effect on 21 November 2008:

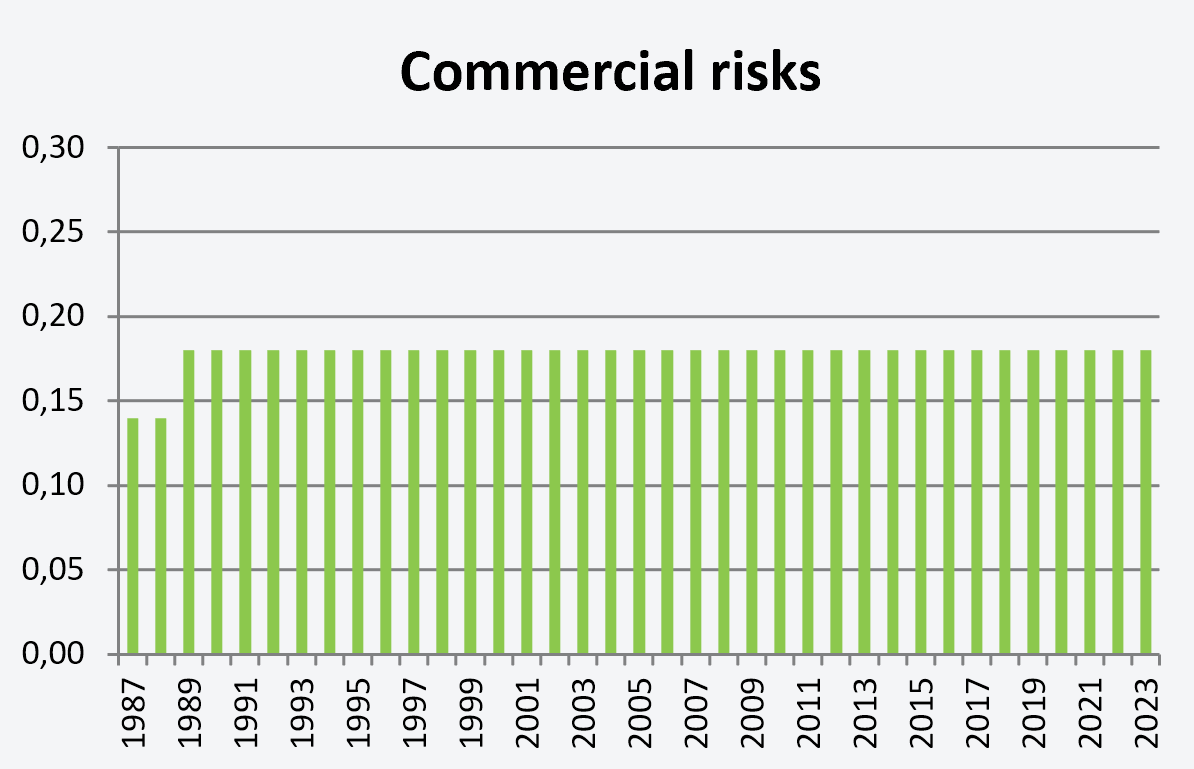

Property damage covers: the rates for residential building and industrial covers were lowered; two risk categories, "commercial and other simple risk covers" and "industrial risk covers" were combined into an "other risk covers" category; the first loss rate schedule was simplified; seasonal insurance cover rates were eliminated (replaced by a proportional calculation based on the validity period), and a minimum surcharge of one euro cent was set.

Royal Decree 300/2004 enacted the implementing regulations for extraordinary risks and set the following deductibles:

For property damage covers, 7% of the amount of the indemnifiable damage caused by the loss. This deductible will not apply for losses involving vehicles with automobile insurance policy coverage, residential building coverage, or condominium residence coverage.

Royal Decree 1265/2006 amending the Implementing Regulations changed the deductibles as follows:

"Where a policy specifies a combined deductibles for property damage and lost profits, the Consorcio de Compensación de Seguros will apply the deductible of section 1 from the property damage settlement and the deductible specified in the policy for the main cover from the lost profits less the deductible applied to the property damage settlement".

Royal Decree 1060/2015 (Final Provision Three) amending the Implementing Regulations provided:

"1. For automobile damage and third-party liability, the deductible set by the Minister of Economy and Competitiveness on the recommendation of the Consorcio de Compensación de Seguros will apply.

2. Personal injury covers will not be subject to any deductible."

Orden ECC/2845/2015, de 23 de diciembre [Ministry of Economy and Competitiveness Decree 2845/2015 of 23 December 2015] contains the provisions concerning deductibles currently in force. It took effect on 1 January 2016 and reads:

"Sole section. Deductibles to be applied by the Consorcio de Compensación de Seguros in cases involving extraordinary risk covers.

The preceding discussion shows that the covers, rate schedules, and deductibles of the Consorcio de Compensación de Seguros have evolved in keeping with the principles of conservation and continuity to stay aligned with needs as required at all times.

The trend for the perils covered has been for them to undergo more detailed enumeration and definition and subsequently expansion, while the rates tended to increase up to 2008 and since then have tended to decrease. Deductibles have in turn tended to undergo reductions in the applicable rates, and risk categories have tended to be exempted.