This article looks at the key features of the Spanish system for winding-up of insurers, which is handled by the Consorcio de Compensación de Seguros (CCS). It describes its historical background and the reasons which led to its establishment, as well as the procedures and mechanisms it uses, and the legal context in which it operates. It also includes an assessment of the period of more than 30 years over which the system has functioned and some thoughts going forward.

Leer más

Far from the existence of a universal solution, the countries with policyholder protection schemes in situations of insurer insolvency -and not all countries have them, not even in the European context- address this issue with a heterogeneous range of solutions.

Leer más

The last financial crisis laid bare the need to develop a new and effective framework for institutions that not only operate within the compass of the European Union but further afield too. In this context the resolution system has improved substantially and meant the introduction of a new raft of legislation whereby the Single Resolution Mechanism (SRM) and the Single Resolution Fund (SRF) were established within the orbit of the banking union.

Leer más

Terrorism methods and objectives have evolved. Insuring for this risk should also adapt to such changing circumstances. Given fresh challenges, and to share experiences among the various different systems of cover and examine alternatives, the International Forum for Terrorism Risk (Re)Insurance Pools (IFTRIP) has come into being. This article describes the circumstances and process behind the creation of IFTRIP from the standpoint of the experience of Pool Re, which is the British pool for terrorism risk insurance.

Leer más

Based on the compensation paid by Consorcio de Compensación de Seguros with regard to property damage caused by hydrometeorological causes (strong wind and flood) and on the sums at risk, a projection has been made for the next 30 years using certain assumptions so as to arrive to an approximation of the capacity of the extraordinary risk insurance scheme to cater for with the expected increase in hazardousness owing to climate change.

Leer más

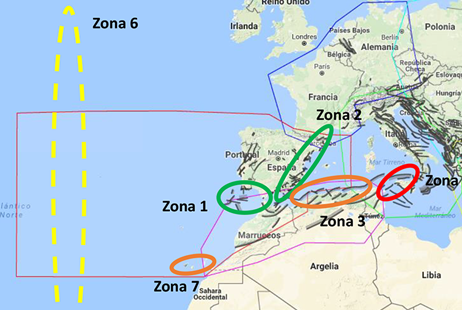

The Directorate-General for Civil Protection and Emergencies has released the results of a study of tsunami risk hazardousness along the Spanish coastline. This is a preliminary study aimed at developing more in-depth risk management plans and studies at regional and local government level, yet which can provide useful information on this thusfar relatively unknown risk.

Leer más

The judgment in discussion refers to the effectiveness in relation to the Consorcio de Compensación de Seguros (CCS) of agreements between the policyholder and their insurer in cases where the premium is not paid in the one-month grace period and the insurance contract between the parties has been suspended pursuant to article 15.2 of the Insurance Contracts Act.

Leer más

As a result of an agreement among several Spanish institutions, a tool has been produced known as the Catalogue of Earthquake Damage in Spain (CDTE for the Spanish), which is intended to provide a unified record for damage caused by earthquakes with a seismic strength of greater than or equal to VI (EMS-98) in Spanish territory.

Leer más